Top section

Top section

Sustainable sukuk standards should educate issuers and investors and could draw wider investment

Akbank opts for use of proceeds sustainable loan, others may drop ESG labelling altogether

The IPO pipeline in the region has been dominated by state owned enterprises but that could change

More articles

More articles

More articles

-

Hire supports BNPP's growing CEEMEA bond franchise

-

Many investors are still uncomfortable with smaller airlines, said one fund manager

-

Trade prices inside the curve of Abu Dhabi peer Mubadala

-

Privately owned Dubai supermarket group is set to begin trading next week

-

CFO and former trader is seen as natural successor after Noel Quinn unexpectedly stepped down

-

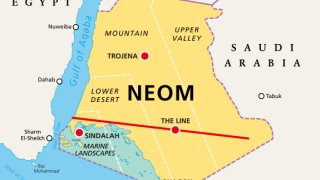

Only Saudi banks provide facility, as Western banks say the lack of ancillary opportunities makes the business case difficult

Sub-sections

-

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa

-

-